|

|

Plenary Lecture

The Basic Theory and an Efficient Soft Computing for a

New Simulation Approach on several Models of Optimal

Stock Management in the Deterministic Case

Professor Nicolae Popoviciu

Hyperion University of Bucharest

Faculty of Mathematics-Informatics

Street Calarasilor 169, Bucharest, ROMANIA

E-mail:

nicolae.popoviciu@yahoo.com

Abstract:

The work is a generalization of three Wilson's models

related with the gestion (management) of stocks in the

deterministic case. A new variable r, called stock rate

or simulation rate, appears in all models. This variable

assures a better stock controlling by deterministic

simulation method. For r = 1/2 we obtain all

Wilson's results from the bibliography [4], [5]. For

each economical model the mathematical foundation is

given, together with several numerical applications and

economical interpretations. All models are based on the

same notations with their specific meanings. So we used

the following notations:

N = The total number of supplies

h = The period length (the number of days, let us

say) between two supplies; h is constant.

cL = The launch cost for one demand of

supply (the ordering cost per one order)

cH = The holding cost (in warehouse)

unit cost, per day

cP = The penalty cost per item, per

day (when the stock s is less then the client's demand)

W = The production rate of the factory, on the

unit time (the model 3)

D = The client's demand rate on the unit time

(the model 3)

From time in time the manager has to stop the production

activity, otherwise the whole quantity WT is too

big, i.e. WT >> Q.

tW = The working time (the production

time) for the factory or industrial unit

tS = The stop time (the factory

doesn't work)

tWP = The working time and the penalty

time for the factory because the client's demands are

not satisfied

tP = The penalty time and stop time

Cr(q) = The total cost (composed of

the ordering and holding cost) for interval , in model 1

Cr(q,s) = The total cost (composed of

the ordering, holding and penalty cost) for interval

[0,T], in model 2

Cr(tS,tP) = The

total cost (composed of the production cost and

ordering, holding and penalty cost) for the interval

[0,T], in model 3

In the above description the elements T, Q, W, D, cL,

cH, cP and r are

input data

The elements q, s, N, h, tS, tP,

tW, tWP are unknown data

(positive real numbers). They must be found by using the

mathematical models for the maintenance stock problem

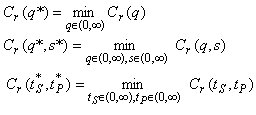

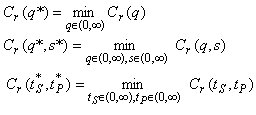

The aim of the stock theory is to determine the best

values q* (model 1), q*, s* (model 2), tS*, tP*

(model 3) which minimize the total maintenance costs,

respectively

Each

mathematical model generates an informatics model and a

C++ program. So, the work contains three C++ valid

programs: source codification, numerical output results

and print screen. The C++ simulation programs have been

validated by supplementary techniques and independent

computations. By simulation with various values of r

a good manager has the possibility to choose the best

version of his activity.

Brief Biography of the Speaker:

Popoviciu Nicolae is PhD in mathematics (from 1976),

professor at Hyperion University of Bucharest, Romania,

Faculty of Mathematics-Informatics and the dean of this

faculty. His area of competence contains: stochastic

processes and Markov decision problems, integral

transforms (continuous, discrete, fast Fourier

transform, discrete Fourier transform), complex

functions, field theory, distribution theory, tensor

computation, mathematical programming (linear,

multi-objective, quadratic, convex, nonlinear,

stochastic, in integer numbers, Boolean) and

optimization models, artificial neural networks and

applications. He is the first author of 18 books (all in

Romanian language) and 102 papers (almost all in English

language) and more exactly the first author of 89

papers. His recently book Neural Networks. Mathematical

Foundation, Algorithms and Applications (2009, Romanian

language) is a monograph on the algorithms of neural

networks with application.

Professor Popoviciu is member of Romanian Society of

Mathematics and member of the Romanian Probability and

Statistics Society. He has participated to many WSEAS

International Conference: plenary speaker, author,

co-author, chairman, reviewer etc (Romania, Greece,

Turkey, Bulgaria, United Kingdom, USA ). |

|